EMV chip technology is becoming the global standard for credit card and debit card payments. Named after its original developers (Europay, MasterCard® and Visa®), this technology features payment instruments (cards, mobile phones, etc.) with embedded microprocessor chips that store and protect cardholder data. This standard has many names worldwide and may also be referred to as: "chip and PIN" or "chip and signature."

The nationwide shift to EMV is well underway and so DBdata. EMV (which stands for Europay,MasterCard and Visa) is a global standard for cards equipped with computer chips and the technology used to authenticate chip-card transactions. In the wake of numerous large-scale data breaches and increasing rates of counterfeit card fraud, U.S. card issuers are migrating to this new technology to protect consumers and reduce the costs of fraud.

For DBdatapos merchants the switch to EMV means adding new in-store technology and internal processing systems, and complying with new liability rules. For your consumers, it means activating new cards and learning new payment processes. Most of all, it means greater protection against fraud.

Coupling EMV with other payment types (such as Point to Point Encryption, or P2PE – and NFC, the technology behind ApplePay and Google Wallet) will give you and your clients the ultimate protection against fraud and data breaches.

Chip technology is an evolution in our payment system that will help increase security, reduce card-present fraud and enable the use of future value-added applications. Chip-enabled cards are standard bank cards that are embedded with a micro computer chip. Some may require a PIN instead of a signature to complete the transaction process.

Simply put, EMV (also referred to as chip-and-PIN, chip-and-signature, chip-and-choice, or generally as chip technology) is the most recent advancement in a global initiative to combat fraud and protect sensitive payment data in the card-present environment. Payment data is more secure on a chip-enabled payment card than on a magnetic stripe (magstripe) card, as the former supports dynamic authentication, while the latter does not (the data is static). Consequently, data from a traditional magstripe card can be easily copied (skimmed) with a simple and inexpensive card reading device – enabling criminals to reproduce counterfeit cards for use in both the retail and the CNP environment. Chip (EMV) technology is effective in combating counterfeit fraud with its dynamic authentication capabilities (dynamic values existing within the chip itself that, when verified by the point-of-sale device, ensure the authenticity of the card).

No. The chip technology standard for payment was first used in France in 1992. Today, there are more than 1 billion chip cards used around the world. The U.S. is one of the few industrialized nations that have not fully transitioned to this technology standard.

.

Preventing the growth of card-present fraudulent activity is one of the main reasons the industry is moving toward EMV technology. Chip cards make it difficult for fraud organizations to target cardholders and businesses alike. As a result, more and more chip cards are being introduced by U.S. financial institutions in order to support and switch over to this technology.

In addition, Visa, MasterCard, Discover and American Express have announced upcoming liability shifts for credit card transactions based on this standard. Any merchants or issuers who do not support chip technology may be liable for the cost of counterfeit fraud. The term “Liability Shift" refers to the change in who bears the chargeback related cost of fraudulent transactions. The timeframes for compliance are:

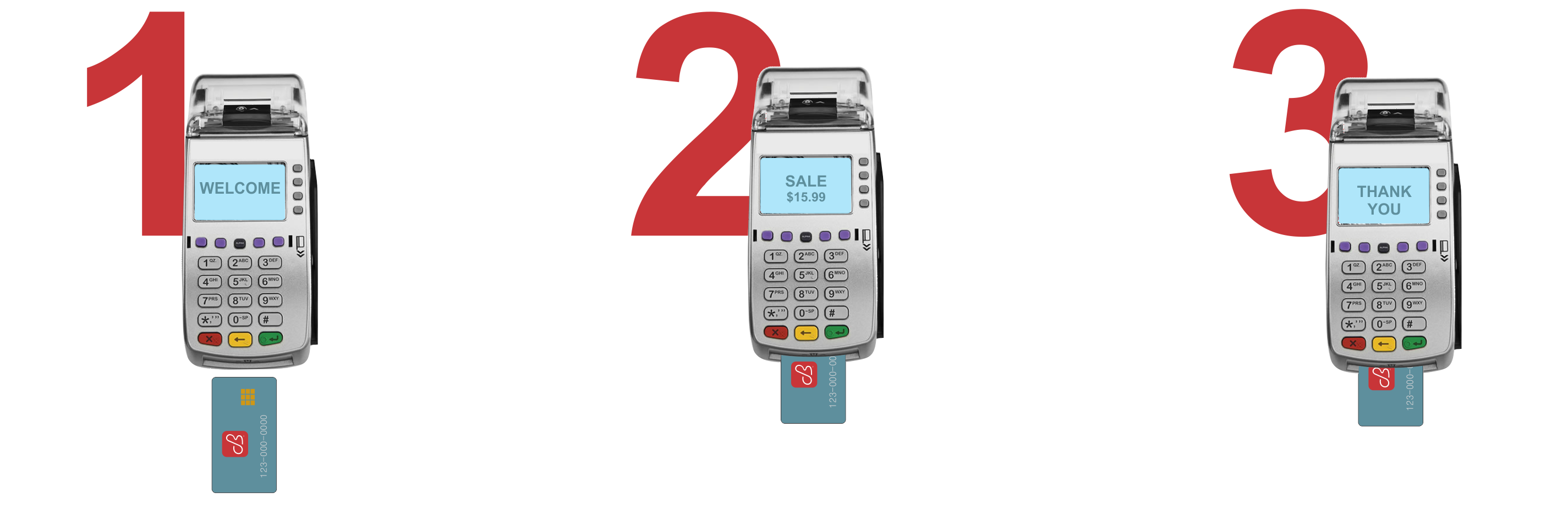

As U.S. merchants begin transitioning to chip card readers, consumers will notice the payment process works a little differently. Not all devices will look the same, but the steps are nearly identical. Here's how it works:

| Rather than swiping your credit card, you will insert it into the front of the card reader with the chip facing up. | Keep it in the card reader, and follow the prompts on the screen until your transaction is complete. | Remove the card. If a signature is required, just sign the receipt and you are done. |

Make sure the card is inserted into the terminal's chip reader slot face up with the chip first. The card must stay in the terminal's chip reader slot for the duration of the transaction, which ends when the receipt is being printed. If the card is removed before the end of a transaction, the payment will not be processed.

The Quick Reference Guide for Partners terminal and our POS System has many tips and troubleshooting steps specifically related to chip cards. As you become familiar with chip technology, remember that you can call for technical support if you have any questions.